The best time to buy a house is 10 years ago. Have you ever heard that? It’s true but impossible. The next best thing is to buy a property now. Actually, that’s not true right now.

There are several reasons not to buy a property now:

- Interest rates are on the rise, shooting up past 6% and heading higher;

- Houses/properties are way overvalued;

- People still believe they can get top dollar for their property.

Over the past 2 years, interest rates were at historical lows. So people could buy an expensive (for them) property and pay a reasonable mortgage. But now, houses are really really expensive (in most places where people want to live.)

Now, the Fed raising interest rates has put the kibosh on selling an over-priced house. But people still have to move. And houses are starting to sit on the market because a 6% mortgage is a lot more expensive than a 2% mortgage. As these houses sit on the market, the number of houses for sale will increase. As demand decreases the housing supply will increase. Simple economics. As I said, people still have to move. And they are going to get desperate to sell their property.

That’s where you come in. You can save them by taking over their mortgage. You see it’s not the price of the property, but the cost of the monthly mortgage that matters most. And, lots of these people that really need to move have no equity in their property. In fact, a lot will be underwater as the market corrects due to higher interest rates. Selling their house will actually cost them money. Ouch!!

This technique works best if you plan to buy and hold a property. If you can make the mortgage payment, it really doesn’t matter how much is owed on the property because its value is going to fluctuate anyway.

Wait, but you can’t take over someone’s mortgage, there’s a due-on-sale clause in every mortgage now. Not so fast. Using a little-known technique that Attorney/Investor Bill Bronchick suggests, you can legally take over an owner’s mortgage without triggering the due-on-sale clause. Check out how to do this in his course “Buying Properties Subject To.” Use the discount code “legalwiz4u” to get a 20% discount on his courses.

But wait, a caveat if you please….

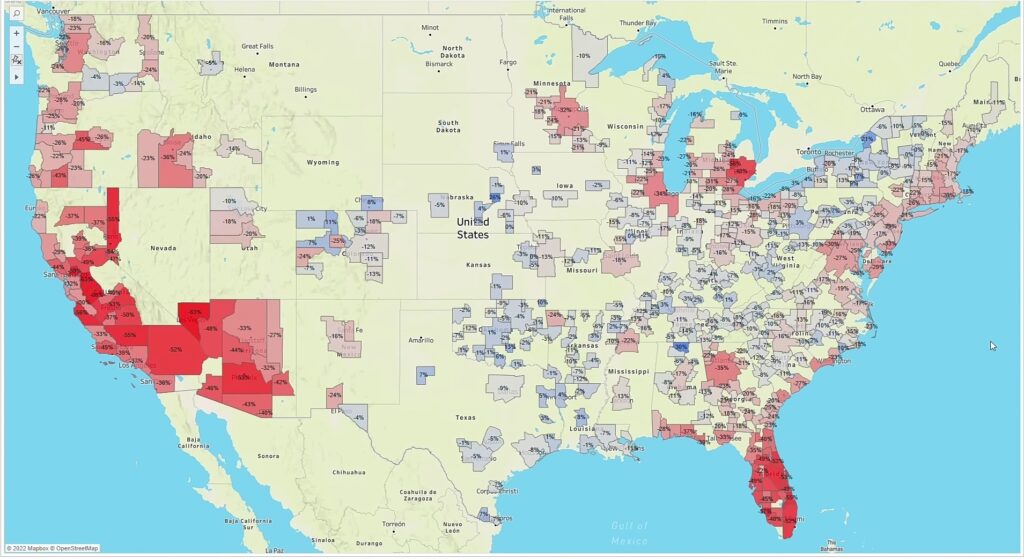

Now, this advice actually depends on where you live. If you look at the price changes from the subprime collapse of 2007-2012 (figure 1) you’ll see the areas where the biggest drops occurred during that time. Interestingly, the areas in blue actually appreciated during that time.

Now, look at the areas that have the greatest increase in housing supply (Year/Year ) now (Figure 2.)

The technique I’ve discussed here applies pretty much to the places in red. The places in blue are still experiencing a housing shortage.

Now, for the areas in red, it’s not quite time to take over mortgages. Yet. Sellers aren’t motivated enough. The real estate professionals I’ve talked to suggest waiting a year before there’s enough oversupply to push sellers in this direction.