This is just another instance of playing cat and mouse with “well-meaning” government bureaucrats. Actually, it’s more like Goedel’s Theorem, but that’s for another day.

The problem began with the infamous “due on sale” clause instigated by lenders in the 1970s when interest rates went sky-high. Remember interest rates of 14%?? People were assuming low-interest loans and lenders hated it. So, presto! Due on Sale clauses were introduced. Basically, the “due on sale” states that if there is a change in title, the loan is immediately due in full. Well, this led to the Garn-St Germain Act which left a loophole, lenders couldn’t enforce the “due on sale” clause if the property was transferred to a trust. So that is probably what is being done here. It’s complicated, but as Bill Bronchick says, “There ain’t no due on sale prison.”

What I’d hoped for today was that it would be similar to 2008. The Barney Franks of the federal government screwed up with their Community Restoration Act, which led to the subprime meltdown, and the ensuing fiasco that caused companies like Bear Sterns and Lehman Brothers to go under (not that they didn’t deserve it.) Then private investors, like me, stepped in, took on the risk, and bailed them out. The process sucked, but I could make a few bucks bailing people out of their problems.

Back during the subprime crisis in 2008, I took over lots of people’s home loans, via “subject to.” (“Subject to” means that you’re taking title to a property “subject to” the underlying loan.) Back then, there was lots of inventory. The market was tough, people had to sell. They had interest rates of 5%-7% on 30-year fixed-rate loans, you know, normal rates. People had problems. I solved them. Simple, straightforward.

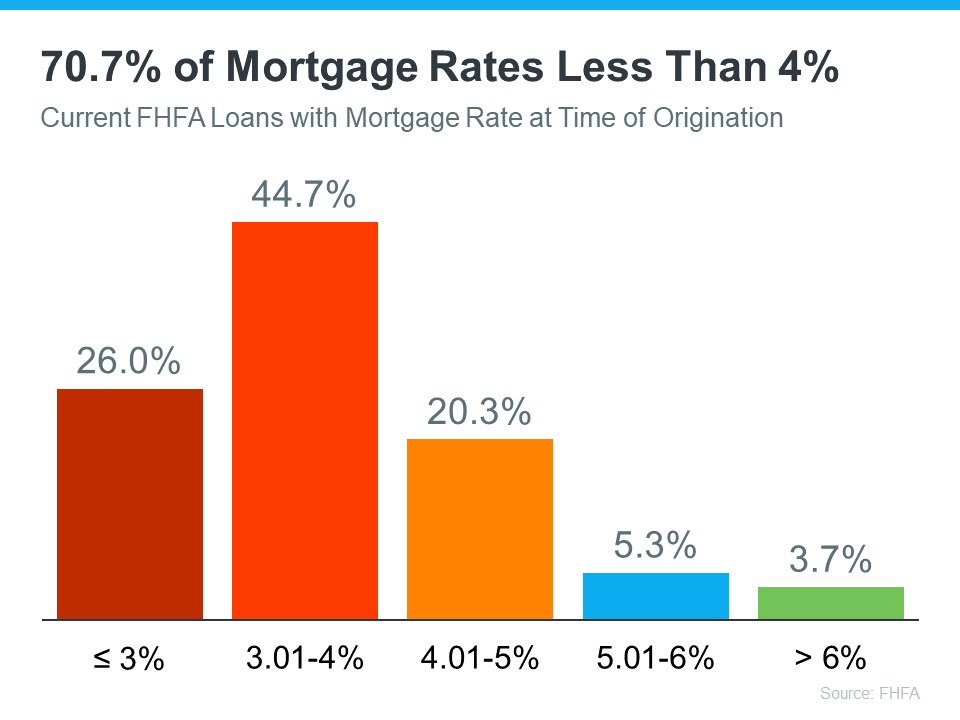

Ah, but today is different. People have super-low interest rates (Figure 1.) But, inventory is low, because people have jobs. They can just hang out and keep paying their mortgage as long as they have a job. As long as inventory is low and demand is high, home prices will keep increasing. But interest rates have gone up significantly, try around 8%. This one-two punch has led to unaffordability in the housing market. It’s just like California, but almost everywhere.

People can’t move from their 2%-3% loan home. In fact, their appreciation combined with 8% interest should make it nearly impossible to sell their house, but the one thing that people need is a place to live. So, they pay the ridiculous price of a house. Normally, you don’t want more than 30% of your income going toward house payments people are willing to spend 50% on their house. Yikes!!

Taking over someone’s home loan works, but pretty much only in places without much appreciation. BTW..good luck finding those places today. LOL. You see, people who took out loans at 2%-3% in appreciating markets now have $50k-$100K+ in equity (Figure 2.) And, it’s only getting worse (Figure 3.) So taking over a loan is great if you have an extra $50K-$100K on hand. Which I don’t and only a few people do. That’s the conundrum.

So, until inventory goes up, taking over a property via “Subject to” or putting in a trust and assuming trusteeship is problematic (I love that word.) Unless you have the cash. Cash is king.