I remember a comic by Gary Larson in the Far Side with a mustached man in a lab coat in front of a board full of what looks like partial differential equations concluding with “= $” and the line “Einstein discovers that time is actually money.” OMG!! Too funny!

I had a recent experience that sheds multiple lights on the saying time is money. In real estate, Real Estate Guru, Ron LeGrand was fond of saying many things including “You can’t steal something slowly.” Which correlates well with my first example below.

Serious People Move Fast

I had this property under contract that was in foreclosure. It was for a condo that was worth around $85K. The condo didn’t need much except for paint and carpet. It was probably 800 ft^2 in total. Two bedrooms and a bath.

I shopped it around to a few investors. One guy was interested, but his father had to approve the deal. Apparently, they were partners. The guy, we’ll call him Dan, said he was really interested. Dan said, “just give me a day or two.” Two days turned into a week. I finally cornered Dan, “What’s it going to be?” I asked. Finally, Dan said his Dad wasn’t too sure about the project.

I euphemistically hung up the phone and immediately called another investor. Within two hours he said, “I’ll take it.” He got the deal. Simple.

But you have to think like this. If someone is interested they’ll move; if not, they’ll delay and drag their feet. It’s like they don’t want to say no to you. Watch for this. If someone is dragging their feet; drop them and move on. Most times they weren’t really interested anyway.

To Maximize your profit, Use a realtor

To make the most profit when you’re selling a house, use a realtor. Sounds pretty simple, but in the long run, use a realtor. Yes, it takes longer, but that’s the point. These people will market your property to the broadest audience giving you a chance to make the most money. The cost is worth it.

The Yin and Yang of Time and Money

When selling or negotiating for a property there are two variables that are intimately connected: time and money. Sometimes they are inversely proportional; sometimes directly proportional. For example, the longer your property sits on the market, the lower its value becomes and the less Money you usually get. There are a plethora of reasons why a property sits on the market but it usually boils down to price, i.e., money. You’re asking too much.

On the other hand, if you’re in a hurry to sell, you must discount the price for a quick sale. The shorter the timeframe, the bigger the discount and the less money you get. By discount, I mean, take less than the property is worth (in your eyes.)

In these examples, time and money act differently for each situation. But the real difference is your perspective value of time and money. Which is more valuable at this moment? This is a reasonable question because their values are constantly changing. Usually, everyone wants to minimize time and maximize money, but not always. Sometimes as an investor time is more critical than money. When someone wants a quick sale because they’re being transferred tomorrow, then time trumps money. If you can let the property sit for a while, then money trumps time.

Exchanging Time for Money

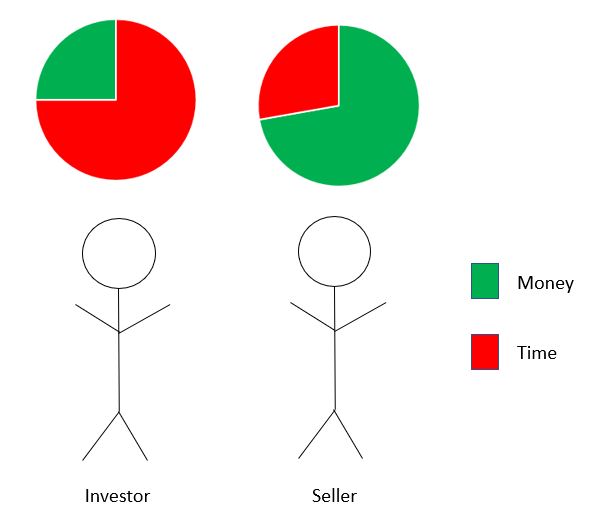

Everything is negotiable. You can exchange money and time. In most people’s jobs, they exchange money for time. In the examples above you can see how people trade money for less time but in the opposite sense of working for money. You as the investor can do the opposite, trade money for more time. In Figure 1, you see a buyer and a seller. Above them are two pie charts representing their respective value (or abundance of either time or money.) Both parties value what they have the least amount of.

If someone is willing to wait for a little (or a lot) longer time for their money, then I can give them more money because they are giving me more time. For example, in a lease/purchase situation, I may give the seller their asking price.

When I meet someone who needs to get out of their property fast, I mean like yesterday. I know that time and not money is the real issue. So that’s what I try to address. Remember when you’re talking to a seller, try to figure out what is more important to them: time or money. Then structure your negotiations with that in mind.