At this writing, Evergrande has failed to meet the self-imposed date for a restructuring of its $300 Billion debt. Evergrande is the most indebted company in the world!! Which is about 4x the amount of debt held by Bear-Sterns during the sub-prime meltdown of 2008.

Evergrande restructuring is a fantasy. It is totally impossible for any company without a product to sell to make any payments. Evergrande will ultimately end up being bailed out by the CCP. So will all the other property developers in China.

Now, China has over 60 million vacant uninhabitable apartment buildings referred to as Ghost Cities. And, it is unlikely they will be habitable anytime soon since they lack any utilities including water, gas, electricity, windows, fire escapes, elevators, etc. That’s all. LOL.

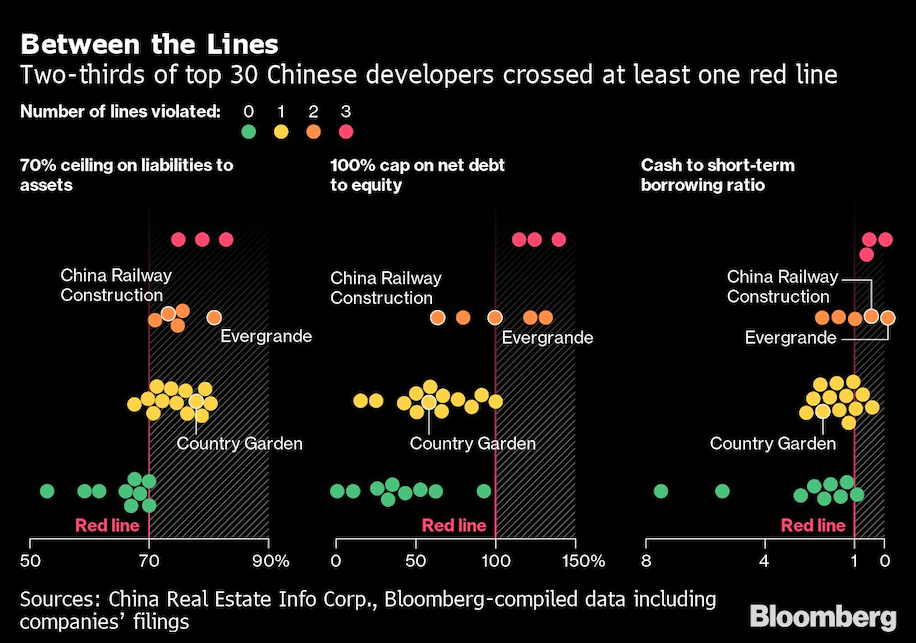

The housing bubble popped last year after the CCP implemented the Three Red Lines (Figure 1.) The Three Red Lines consisted of requiring property developers to have certain values before they could acquire more debt including Debt to Cash; Debt to Equity; and Debt to Assets. And, as a reminder, not one of the top 30 Property Development Companies in China met these criteria.

January 14, 2022

Evergrande used to be the largest property development company in China has slipped to #2. Now the largest property development company is Country Garden Holdings (CGH.) They just discounted their stock by 13% to entice investors so they can generate some cash (about $360 Million US.) They will ostensibly use this money to pay some of their offshore debt. But this is just a stop-gap. More bonds are due in 3 months, 6 months, etc. CGH has a bunch of ghost properties, too. These properties have no value, so no one is buying them. With no money, how will CGH pay future payments? This problem won’t be going away because their business model is based on a property bubble. It’s always been a Ponzi scheme destined to fail.

And if that weren’t enough, and don’t you think it ought to be? The Chinese banking system is failing because they loaned a lot of money to these property developers. Last week, there were a bunch of bank failures in China. As a result, there were lots of protests because the banks simply closed their doors to bank members. The CCP sent in groups of thugs and tanks to disperse the protestors. That’s how the CCP works.