“History doesn’t repeat itself, but it often rhymes” – Mark Twain

The 2008 subprime financial crisis was just a precursor to the greatest real estate collapse in history.

At the time of this writing, the Chinese real estate market is collapsing. This market tops out at $6 trillion! This is bigger than all of the Western real estate markets combined. The 2008 subprime disaster is insignificant in comparison.

The focus of the collapse is a Chinese real estate company called Evergrande. Evergrande is a real estate development company. Currently, Evergrand has assets in excess of $300 billion dollars. Evergrande has been doing a Ponsi scheme. They sold properties to Chinese citizens, collected the cash. And, instead of building the units they sold, they used the money to start other projects.

Factors contributing to the Evergrande collapse:

- Chinese Communist Party’s restrictions on what and where the Chinese people can put their savings. You can’t save money, but you can invest in real estate. So, no investment diversity.

- China’s one-child policy (1980-2015) resulted in significantly more males and fewer females. The one-child policy was aimed at curbing overpopulation. But linear thinking in a non-linear world has repeatedly got the Chinese Communist Party into propblems. A characteristic of the Chinese culture is that all the Chinese people want a son. So, they often aborted their female children. Here’s the downside of that type of thinking. According to the website statista.com, China boasts the world’s most skewed sex ratio at birth at around 111 males born for every 100 females as of 2020. In contrast, the United States has a male: female ratio of 97. (which begat the “me too” movement. You just can’t win, can you?) Here’s where supply and demand come into play. Because wives are in short supply, a potential suitor must show that he has adequate means to provide for his bride. (This is the same thing male peacocks do. The better the plumage, the better provider he will be.)

- To prove his higher status, a male suitor would own more real estate. To help out, families would help purchase a property sight unseen from Evergrande. Just to say they own more real estate. These poor suckers, err…people would get a mortgage and start paying on a note for a property that wasn’t built yet. Now, Evergrande promised to build them a unit. But, Evergrande didn’t finish a bunch of these properties. When I say a bunch, there are literally 1.6 million unfinished condos in China that are being paid for by their future owners! Some of these buildings don’t have any way to access the various floors, i.e., no stairs or elevators!!

- In November, 2021, Chinese property giant Evergrande, the world’s most indebted company whose liabilities exceed $300bn, missed a $200 million bond payment, one in December for $285M, and another one for $85M. The company is bankrupt!

- Recently (Jan. 2022) Evergrande’s crowning achievement was to be Ocean Flower Island the largest land reclamation project in the world. It’s bigger than the one in Dubai. Recently, Evergrande got hit with demolition orders for 39 of its luxury apartment buildings reportedly because the building permits were illegally obtained. Yikes! How many other properties did Evergrande do this at?

In China, corruption at the mega-corporate level is looking pretty normal. It may be because the CCP encourages corruption. The same corruption emerged in the former Soviet Union after the Berlin Wall fell. Two high-profile examples of corruption that involved heavy Wall Street Losses include:

- Luckin Coffee. Nearly $4B of investor’s cash was lost when Luckin Coffee filed for bankruptcy in February, 2021. Luckin Coffee was the largest coffee shop in China. Apparently they were cooking the books, i.e., fabricating figures. Muddy Waters, a hedge fund, revealed massive fraud at Luckin.

- Ke Holdings, Inc., Chinese version of Zillow, 2020 largest IPO at $2.1B. Ke Holdings developed a big online presence. Muddy Waters, again, revealed that Ke Holdings is fabricating it figures. According to robbinsllp.com, KE Holdings, Inc. is accused of disseminating false and misleading information regarding rransaction volumes, store count and agent count, and transaction data

Both of these companies are being investigated for various improprieties. These are just two massive examples of the business environment in China. Both Luckin Coffee and Ke Holdings, Inc. were initially offered on American Stock Exchanges. Luckin Coffee is bankrupt. Ke Holdings and Evergrande are expected to follow suit. Evergrande is now in the hands of a risk management committee consisting of a number of CCP members. In addition, China’s $10B high-speed trains are also in trouble.

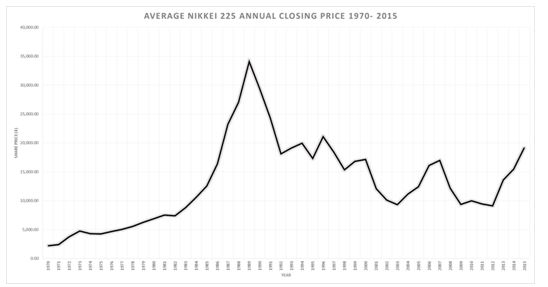

If history is any indicator, none of this bodes well for the Chinese economy. A similar event happened in Japan in the 1990s. This is referred to as the Lost Decades. The Lost Decades started with the real estate collapse in 1991. The Nikkei index, i.e., the Japanese stock market, has yet to reach its peak from 1988-1989. The same thing is possible for the Chinese coming Chinese real estate collapse.